Optimization will be the main focus of IT projects in 2010 as the industry slowly emerges from the impact of the economic downturn. However new investment topics are also emerging.

London – January 29, 2010 – The economic crisis had a huge impact on the world IT market in 2009. “Companies reviewed IT investment agendas, halted some pro-jects and postponed many others. They also examined subcontracting policies, putting strong pressure on daily rates, consolidating the number of external provid-ers and leveraging fixed price engagements with more sophisticated metrics (func-tion points, work units, etc.),” says Christophe Chalons, Chief Analyst of the PAC Group, based at PAC Munich. However, as IT continued to play a more and more strategic role, companies focused on optimization of IT assets/ IT asset utilization in 2009 rather than pure reduction.

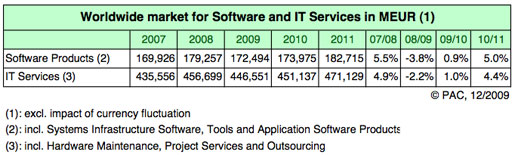

In 2010, PAC believes that the crisis will further impact the IT sector, at least until the end of the first half of the year.

Investment priorities for end-users

“Optimization will remain the #1 priority for end-users for IT related investments,” adds Christophe Chalons. “As in 2009, this will take shape in many forms, such as server consolidation and virtualization in the infrastructure space.”

“Application development and maintenance engagements in the application arena should continue to benefit from consolidation strategies,” comments Nick Mayes, Senior Consultant IT Services based at PAC London. Service Oriented Architec-tures (SOA) provide flexibility for companies – although through focused, point projects rather than broader migration and transformation engagements. “Besides SOA, Open Source (especially in Europe) is another key enabler of the cloud revo-lution,” comments Mathieu Poujol, Director of PAC Group’s Technology practice, based at PAC Paris.

“Cloud computing models that offer efficiency and flexibility should thrive in this environment,” says Karsten Leclerque, Director of the outsourcing practice, based at PAC Munich. While reliability, security and compliance issues remain in the pub-lic cloud infrastructure models, projects that focus on the design and build of private infrastructure clouds that bridge private and public platforms should be buoyant. Other low-cost strategies will continue to be selected by end-user companies includ-ing standardization, Open Source and offshore.

“Recent developments in mobile Internet and in the booming market for smart phones will push companies to extend applications to cover mobile platforms and satisfy demanding customers,” says Frederic Giron, Director of the IT Services practice, based at PAC Paris. For example, projects around mobile payment appli-cations should prosper once there are clear signs of recovery.

While mainstream adoption of machine-to-machine technologies remains far away (mainly due to very high fixed costs for M2M projects), projects around embedded systems will continue to drive growth in several sectors, including automotive and utilities. “Embedded software is also a key element of Smart-X projects that should come to heed in transportation, energy, healthcare, etc. sectors, some of which will benefit from stimulus packages launched in 2009 by most national economies,” says Peter Russo, Director, based at PAC New York City.

Christophe Chalons continues: “Regarding process efficiency and company agility, the key topics will be collaboration and workflow, process automation/ process integration/ process harmonization/ process improvement, with a special focus on sales/ CRM/ customer services, and Information Management”. “Social networking functions should also make apparitions in several mainstream products,” adds Mathieu Poujol.

Finally, Governance/ Risk Management/ Compliance (GRC) issues will continue to generate substantial IT investments, particularly in financial services.

Challenges for suppliers in 2010

In response to these investment points and trends, suppliers must continue to adapt their activities in a buyer’s market.

2010 – the recovery?

The recovery is expected to start in the course of 2010, earlier or later depending on the country. PAC has remained cautious, as there are still important risks linked with unemployment, the credit crunch and resulting bankruptcies. “In any case, even if volumes are expected to recover in the course of 2010, average prices and rates will be lower than in 2009 and will limit market recovery,” concludes Christo-phe Chalons.

About Pierre Audoin Consultants (PAC):

Pierre Audoin Consultants (PAC) is a global market research and strategic consulting firm for the Software and IT Services Industry (SITSI). PAC helps IT vendors, CIOs, consultancies and investment firms by delivering analysis and advice to address a range of growth, technology, financial and operational issues.

Our 30+-year heritage in Europe – combined with our US presence and worldwide resources – forms the foundation of our ability to deliver in-depth knowledge of local IT markets, anywhere. We employ structured methodologies – undertaking thousands of annual face-to-face interviews on both the buy and sell side of the market, as well as a bottom-up, top-down approach – to leverage our research effectively.

PAC publishes a wide range of off-the-shelf and customized market reports – including our best-selling SITSI® program – in addition to our suite of strategic consulting and market planning services. With 16 offices across all continents, we deliver the insight that can make a difference to your business.

For information on the article, please contact:

Christophe Chalons

Chief Analyst

Tel: +49 (0) 89 23 23 68-17,

c.chalons@pac-online.com

Frederic Giron

Director

Tel: + 33 (0) 1 56 56 63 28

f.giron@pac-online.com

Press Contact:

Shelly Wills

Group Marketing Coordinator

Tel: +44 (0) 20 7553 3965

s.wills@pac-online.com

Pierre Audoin Consultants (PAC) Ltd

15 Bowling Green Lane,

London EC1R 0BD, UK

Tel: +44 (0) 20 7251 2810

Fax: +44 (0) 20 7490 7335

Web: www.pac-online.com