In December 2009 the Polish based market research agency DiS released the analysis of business process outsourcing (BPO) and shared service centres (SSC) in Central and Eastern Europe (CEE), with Russia. The review indicates considerable potential of this region, on the area of information technology, finance and banking, as well as electronics, automotive industries, telecommunication and consulting. This potential is expressed by nearly 158 thousands persons employed in above 750 surveyed locations in 19 countries.

The growth in employment show its robustness, even nowadays, when the economic downturn is reported all over the world. The majority of surveyed centres operate in the field of IT (70%). More than 40% carry out research and development activities (R&D). The model of business process outsourcing (BPO) is present in 66% of the centres, with 12% working simultaneously as SSC.

Languages

A variety of natural languages in which communication with BPO/SSC centres can be provided indicates their capacity for transnational cooperation. The majority of the analysed centres, apart from its native, offers at least one additional language for communication. In predominant cases it is English which is spoken in almost 100% of the surveyed outsourcing centres. The second language is German in which above 50% of centres can provide their services. Quite popular is Russian, as a native language for Russia and semi-native language for Belarus, Ukraine, Moldova and Baltic States. Another, not only European inhabitants’ languages worth mentioning are French, Italian and Spanish.

Transnational literacy in languages within CEE region seem to be quite high. A relatively high number of entities deliver wider language services. About 80 surveyed outsourcing centres in CEE offer 10 and more languages whereas 190 centres dispose at 6 and more languages. Usually the largest entities can provide higher number of languages.

City Locations’ Comparison

In the surveyed 750 cases the outsourcing centres of CEE region are located in nearly 200 cities. However the 50 biggest cities concentrate nearly 90% of total employment of BPO/SSC in the region. The main role is played by top ten locations, which according to DiS research concentrate about 70% of employment in BPO/SSC industry.

More than one centre out of 750 surveyed operates in barely about 70 of the cities. In other, usually smaller locations, only single centres were established. This phenomenon means that larger cities offer significantly more favourable conditions for outsourcing centres than the small ones. Nevertheless it is expected, that the list of locations of outsourcing centres will be extended further. Probably, it will be the distant suburbs of large agglomerations, and other cities with population 100-200 thousands inhabitants and for single locations some special cities with tertiary schools’ traditions with less than 100 thousands of inhabitants. As a result of the expansion, the concentration of the employment in top ten most popular cities, is expected to slowly decrease.

Budapest is a capital of BPO/SSC industry within CEE region. In this city the largest number of employees is engaged, nearly 15 thousands. Because of relatively small amount of outsourcing centres (41), the average number of people employed in statistical centre in Budapest is very high (363) in comparison with other large cities.

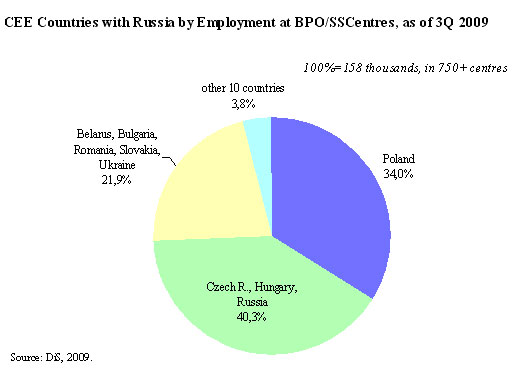

Leading Countries

The four countries who employ the largest amount of people in BPO/SSC centres is Poland, Russia, Hungary, and Czech Republic. These four engage about 75% of human resources working at 750 centres in 19 surveyed countries. According to data as of 3Q 2009, Poland’s advantage was very strong, in comparison to the second country in the region – Russia.

After ten years of experience with outsourcing services there can be selected some countries with their prevailing experience in some specializations. For instance the highest percentage of centres specialised in IT show Belarus and Russia; the highest percentage of call centres show Slovakia and Bulgaria; the highest percentage of F&A centres show Latvia before Hungary; the highest MRO centres show Slovenia and Belarus. In absolute numbers the advantage of Poland and Russia against to smaller countries is quite conspicuous, but this determines that the specialisation of Russia in IT industry is particularly strong. Contrarily in Poland, too many advantages in different outsourcing areas prevent to show this country as a leader of only one industry.

Few words about DiS: the company operates since 1995 as an independent market research agency, based near Warsaw (Poland). It specializes in studies of software applications in various areas of the economy. The company’s achievements comprise more than one hundred various reports and studies on IT market in Poland and neighbouring countries prepared for both widespread professional audiences and sometimes to individual order. Industry reports, include such series as: Commercial Software Review, Software Market and Services, ERP systems, quarterly analysis of the Polish IT market, and numerous reports on IT in the public sector, telecommunications, energy, insurance and retail.