The emergence of Information Technology Outsourcing (ITO) in the 1980s and Business Process Outsourcing (BPO) in the 1990s saw U.S.-based firms strike a slew of mega deals. At the outset, buyers felt secure in outsourcing services to name-brand suppliers with access to capabilities and resources. So it was natural that they turned to that supplier for a large scope of services — the integrated supplier approach.

However, as the market digested these deals and buyers became more comfortable with the concept of outsourcing and offshoring business functions, a new trend of smaller deals for specific areas of opportunity with specialists and niche players emerged, creating an increased number of multisourcing solutions in the marketplace.

Proponents of the integrated supplier approach point out the benefits of reduced governance cost, avoidance of complexity, end-to-end accountability, scale advantages, and integration. The hot new trend is multisourcing and proponents are pointing out the value of matching supplier capabilities to specific needs and reducing the risk of being completely dependent on a single supplier.

Which approach is best?

Both camps are correct. The trick is finding the right balance.

Early buyers of mega-deal outsourcing have learned that giving too much scope to a single supplier creates the high cost of sub-optimizing the supplier fit to each in-scope process. In addition, it is becoming clearer that there are limited scale benefits when sourcing across business functions.

Multisourcing solves some of the problems associated with granting too much scope to a single supplier, but the adopters of multisourcing need to be careful not to over-exercise the approach. While it is true that leveraging specialists for specific processes can deliver value to the bottom line of buyers, they need to exercise great care in defining the functional boundaries when outsourcing to multiple suppliers. If they define the boundaries incorrectly or push multisourcing to the extreme of fragmentation, buyers can be burdened with additional costs that may not only destroy the benefits but also introduce inefficiency.

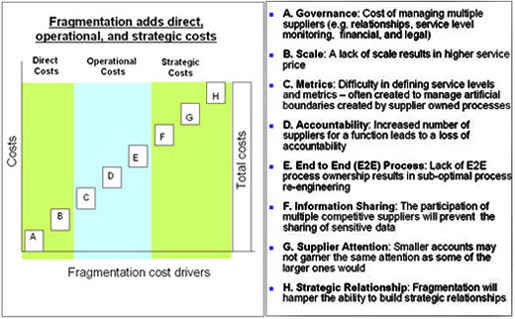

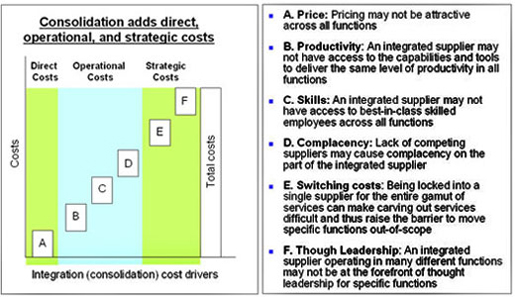

The costs of extreme fragmentation or consolidation can be classified into three categories:

Figure 1 – The costs of fragmentation

© 2008 Everest Consulting Group Ltd.

Figure 2 – The costs of consolidation

© 2008 Everest Consulting Group Ltd.

Figure 1 demonstrates that sourcing business sub-functions such as accounts payable, accounts receivable and general accounting from too many specialists outweighs the benefits. For example, a lack of scale results in higher service price, and the increased number of accounting suppliers leads to a loss of accountability.

Figure 2 above illustrates the costs associated with sourcing too many business functions such as HR, IT, and Finance from an integrated supplier likewise outweighs the benefits. For instance, an integrated supplier doesn’t have access to the specialty tools to be able to deliver the same level of productivity in all functions, and the lack of competing suppliers may cause supplier complacency.

What’s the right place in the spectrum for buyers?

So where in this spectrum should buyers position themselves? In other words, how do you get the benefits of multisourcing without undue fragmentation? The right answer depends upon the following:

This means that the right answer is different for different buyers at different points in time for different business functions. Does the answer lie in consolidating sub-functions with a single supplier? The marketplace is full of examples of sophisticated buyers with the governance acumen to manage IT multisourcing arrangements, such as two application maintenance providers, a data center provider, a telecom provider, and a desktop support provider.

However, this does not mean that multisourcing IT services is the right solution for all buyers. There are numerous examples of buyers who have failed in IT multisourcing. Errors in the solution design, such as making poor choices on scope boundaries is one cause of failure. Another is assigning too little talent to governance, allowing all the risks of multisourcing to come to fruition — loss of end-to-end accountability, loss of coordination, poor integration, etc.

The current trend in IT is toward multisourcing, due primarily to the advanced development of supplier capabilities, advanced understanding of the need for governance, and well understood interdependencies.

So, does the answer lie in multisourcing sub-functions? Not necessarily. For example, before the emergence of multi-process Finance and Accounting Outsourcing (FAO), buyers turned to point solution suppliers; they contracted for accounts payable with an AP supplier. But they also contracted for pieces of accounts receivable with collections suppliers, payment processing suppliers, and AR performance analytics suppliers. They then contracted for general ledger accounting support with bookkeeping suppliers. Now, with the emergence of multi-process FAO suppliers, buyers are consolidating these historically fragmented solutions into more integrated solutions with a strategic FAO partner.

With IT moving in the direction of multisourcing and Finance and Accounting moving in the direction of consolidation, which is correct? The answer is they are both correct. The right answer is different for different buyers at different points in time for different business functions.