The market for IT outsourcing service providers in the CEE region is growing at a fast rate, one that is ahead of average rates worldwide. The main factor of growth is that Eastern European companies offer the valuable model of outsourcing services – “nearsourcing”. Companies who are consumers of nearsourcing get all the benefits of the “offshore outsourcing” economic model plus advantages such as cultural compatibility, a similar- or same-time zone and geographical proximity that allows for fast, inexpensive and easy travel to the offices of nearsourcing partners. After the rapid growth in 2006-2007, and with increased maturity in the IT outsourcing industry, both customers and providers became more sophisticated in their working relationships. There has been a shift from simple cost savings as a motivation to valuing the quality of services and efficiency of cooperation between onshore and offshore teams. Companies in the CEE region have a reputation for efficiency and quality of services. The economic downturn is likely to support further growth in IT outsourcing services within the CEE. The independent experts Carl Billson, Mark Dangelo, Parvis Hanson and Don Moskaluk kindly responded to the questions presented below, providing their views on the trends for IT outsourcing in the CEE region and the influence of the financial recession in the CEE region and worldwide.

Question 1. What is the influence of the global economic recession on IT outsourcing market, particularly on IT outsourcing market in the CEE region?

Carl Billson: The indications are that there is a likely increase in outsourcing influenced by the global economic recession and this appears in a wide range of analysts’ forecasts. “Whenever there’s a downturn people outsource more, not less” was a quotation from Gartner analyst Linda Cohen. Gartner reportedly claimed that around 60 per cent of organisations in Western Europe will outsource more IT and business process functions in 2009. This should be positive news for companies in the near-shore CEE region. However, the same firm also predicts that prices for IT services will fall 5% to 20%, with an average reduction of 10% in 2009 due to uncertainties from the adverse economic climate and constrained IT budgets.

Parvis Hanson: Multinational companies are looking how to squeeze cost on every line item it is therefore mandatory also to look at outsourcing. This said they are unwilling to sign new contracts since companies have had mix experiences with outsourcing. Therefore old outsourcing contracts will be revisited at the time of renewal to reduce costs, and new contracts especially in the CEE region will be difficult to sign. The main reasons why I believe outsourcing to CEE countries will be challenging is mainly since most of the CEE region is going through economical turmoil the question is who will still be your partner in 1-2 years time and which CEE outsourcing service provider will have become bankrupt.

Don Moskaluk: Spending has been cautious for the first two months of the year however, its open up and capital projects are going through. It looks like the hype of bad recession is not taking place and people are gearing up for the recovery. Certain sectors do not show any recession, again manufacturing and banks seem to be hit hard. Canadian banks are buying up most of the US banks and they are in a strong position.

Mark Dangelo: The market rebalancing that started in late 2007 will continue to have a permanent impact on global sourcing initiatives, their contractual terms, and the performance criteria used to govern delivery. With changing consumer and financial shifts transforming competitive and operational landscapes, organizations no longer have certainty of vision with regards to IT outsourcing needs. Term variability, risk aversion, and orchestration of suppliers will take precedence over traditional arrangements that once spanned 5 to 7 years across multiple processes.

Question 2. Did the positioning of the CEE region change in 2008 in comparison with other global offshore markets?

Carl Billson: It is possible that the positive perception of the CEE region will have risen during this period, and beyond, as initiatives and publicity help bring the region’s benefits to greater prominence. For example, the creation of the Central & Eastern European Outsourcing Association (CEEOA), with its active membership and publicity via its websites www.ceeoa.org and https://itonews.eu help to educate and shape perceptions of CEE as a worthwhile near-shore destination for IT services. Keeping a country and a region in the ‘business eye’ is a vital aspect especially when there is so much global competition.

Regional and national government has a role to play in raising awareness and providing support for growth in near-shore IT Services. Consider some examples.

A report by the London School of Economics Outsourcing Unit issued in 2009 was, according to the authors, “commissioned as an independently researched report by Hill & Knowlton, who are acting for the Information Technology Industry Development Agency (ITIDA) of Egypt.” The authors note Egypt’s ambitions to extend its offerings beyond the established call centre work and provide suitable analysis and assessment including comparisons with other regions.

A small pavilion of French software and IT services companies was at the 2009 Internet World exhibition in London, their presence apparently supported by French regional government.

A Trade Mission of ten entrepreneurial Ukrainian IT companies visited the UK in April 2009 as part of an EU Project to support small-to-medium sized companies in the IT sector who actively seem export opportunities in providing near-shore IT services to companies based in Western Europe – see www.sme-int.com.ua

Parvis Hanson: No. Outsourcing has been going on for the past 15-20 years, overall the ICT expenditure and therefore the outsourcing have grown strongly over the same period of time. The CEE region is about 10 years behind the Indian Outsourcing sector, however the CEE region is catching up fast by offering a more “nearsourcing” business model. This allows multinational clients to obtain better services such as language skills, similar time zone and closer software production sites.

Don Moskaluk: Not sure on positioning but we saw back in 2008 more on shore off sourcing. Intern the BPO in USA and Canada then off sets to mostly Asian countries. Most have continued the trend into 2009 but are delayed and are being cautious.

Mark Dangelo: The shine for many of the traditional global ITO and BPO providers came off in 2008. Customer doubt with traditional players has lead many organizations to reassess their exposures and contractual obligations. The result has been a more holistic and encompassing review of all players that meet functional and process demands regardless of historical market acceptance – that is beyond India, China, and the Philippines. Cost or arbitrage no longer is the dominate factor when assessing, transferring, and governing offshore labor forces.

Question 3. Has the global economic recession influenced clients’ plans to use the offshore outsourcing services?

Carl Billson: As recorded above, there is an increase in clients’ interest to use near-shore services and/or use more of them. However, this is mitigated by the awareness of the potential ‘backlash’ especially where local employees themselves risk losing jobs in a difficult economic climate affecting every nation.

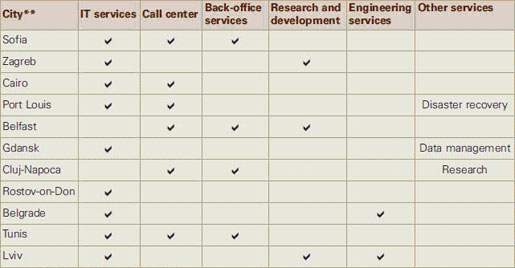

Also, there is constant re-assessment seeking favourable global outsourcing destinations. For instance, an advisory report produced by KPMG in 2009 is titled ‘Exploring Global Frontiers – The New Emerging Destinations.’ The following table taken from this report lists cities in the EMA region (Europe Middle East and Africa):

As can be seen above, CEE region cities are represented in this survey that chose just 31 cities across the globe as outsourcing destinations worthy of note. The report states that the “emerging cities in the EMA region are gaining prominence due to the growing regional market in Europe. Linguistic, geographic and cultural affinity with Europe are the key drivers here.”

Parvis Hanson: Yes. Multinationals companies are more cautious on the promises made about outsourcing. Outsourcing used to be the “magical” formula to reduce your costs, this said most companies have managed to reduce short term the cost by using outsourcing, however the “hidden” costs e.g.. network failures, delay in software productions, misunderstandings between the company and their outsourcing partners are only just now becoming known.

Don Moskaluk: So have quicken the past to get cost saving ASAP, but again most are continuing down a known path such that if they were thinking of outsourcing in 2009 then they are proceeding with plans.

Mark Dangelo: Like political viewpoints, the use or aversion of offshore labor arrangements can reach extremes. What is envisioned for the next 36 months would be a balancing of domestic and offshore workforces using orchestrated delivery techniques. For suppliers, they can no longer show up and “take orders” like they did for two decades. They will be forced to balance local workforces, domestic needs, and corporate profits against their own nationalized desires to provide large offshore environments. We have already witnessed this with one of the top three outsourcing vendors as they proactively diversity their workforces and operations for the fifth iteration of globalization.

Question 4. Are there any new tendencies on IT outsourcing market in the CEE region to appear in 2009?

Carl Billson: With a reported increase in outsourcing from Western Europe, the CEE region is well-placed for winning near-shore IT services work. Established benefits include an innovative well-educated workforce, geographical proximity and short journey times, similar culture and competitive labour rates. The latter naturally vary within countries and tend to be cheaper still in provincial locations, leading to some IT companies having multiple offices.

The recent widely-reported scandal involving outsource provider Satyam in India both un-nerves potential buyers and opens further the opportunities for outsource providers elsewhere, including in the CEE region.

Green IT is an example of a new tendency that affects companies in the CEE region as much as anywhere. Awareness of changing market need and readiness to make provisions obviously increases the attractiveness of a provider.

Parvis Hanson: No. I believe that overall the CEE outsourcing market will continue to develop at a slower speed for 2009, however when the economy of the developed markets picks up again so will the CEE Outsourcing companies.

Don Moskaluk: We see a lot of SAAS and wonderful rates such as CRM for 9.99 dollars US per seat per month however we continue to develop our own SAAS with processing as an added benefit. Most business are looking for the complete picture such that they are looking for everything to be outsourced.

Mark Dangelo: Look for analytics to consume many discussions starting with IT and continuing into the board rooms. The use of known technologies – MDM, databases, BI, cloud computing, et al – will demand a new series of methods and delivery techniques to improve not just cost, but value and responsiveness along the entire operational chain. Analytics will be where the discussions start if a business case is to be achieved. Point-based outsourcing will remain only for those small vendors who are capitalizing on market laggards.

Question 5. What advantages of offshore outsourcing are becoming important for the clients during the financial crisis?

Carl Billson: They are probably the same as before the financial crisis – only more so! Price is obviously a prime consideration but experienced players, and informed new entrants to outsourcing, recognize that value not price is the overriding factor once a range of costs of factored in. Martyn Hart, Chairman of the National Outsourcing Association (NOA) in the UK recently stated that “…parts of Eastern Europe are now beginning to compete with the Indian giants. This leaves a very competitive market for end users to indulge in and …Now companies are asking: where in the world?” (Source: “Your guide to outsourcing and offshoring in a recession” available via the National Outsourcing Association website www.noa.co.uk).

Parvis Hanson: Companies are a lot more internally focused during this financial crisis this means that at the moment they are not looking at new offshoring, outsourcing solutions. Companies have understood that any changes within their ICT working environment has a cost such as implementing the new outsourcing model, new internal business processes, delays etc. I therefore do believe that 2009 and 2010 will be slow growth times for the CEE outsourcers. This said 2009 and 2010 will be business critical for CEE outsourcers to position themselves with a clear business model to profit from the 2011 recovery.

Don Moskaluk: One initially thinks of cost savings but most of the clients we handle are thinking beyond the recession. They are thinking long term. Smaller and mid size companies are looking for cost saving. However, one particular company that has a really large growth rate is not affected by the recession and they are utilizing the recession to get the resource to move further ahead.

Mark Dangelo: When taking into account regional benefits against a global rebalancing of how and where outsourcing is performed, the business case for “thinking global, but sourcing local” has new financial implications. A new set of business realities are facing many Eastern and Western firms as the fifth iteration of globalization takes ahold. As a result, the expected truisms of outsourcing to India and China have been displaced as new skills, markets, and consumer demands outweigh simple labor arbitrage. Tomorrow’s outsoucing arrangements will be about equal prosperity for all local and national constituents. Skills and knowledge worksets will be seemlessly integrated with complex, compartmentalized processes rather than simple call centers and IT sourcing that was the model for 20 years.

Experts:

Carl Billson, Independent Consultant, Flurysh Limited

Carl Billson, Independent Consultant, Flurysh Limited

Carl’s customer-facing roles in Information and Communications Technology (ICT) have assisted organizations to achieve effective business change through the application of enabling technologies. He has worked in both private and public sectors and has experience of mobile data solutions and managed IT services in various sectors. Currently, his work and interests as an independent consultant involves e-Business solutions, secure collaborative working and corporate use of social networking and Web 2.0 tools.

Carl has enjoyed over 25 years of professional involvement exploiting the enabling capabilities of technology, from creating educational software for a global publisher through development of a prototype PDA organizer to enabling companies to be early adopters of e-commerce. Recently, with his own company Flurysh, he’s provided consultancy services in Kiev and London for Ukrainian IT companies wishing to extend their outsourcing capabilities, as part of an EU-funded project.

Parvis Hanson, President of the Manor Group

Parvis Hanson, President of the Manor Group

Parvis Hanson is the President of The Manor Group, the Business Strategic Insights Community. The Manor Group, is a Senior Advisor to the leadership of the Fortune 500 corporations from Asia, Europe and North America. Prior to founding The Manor Group, Parvis Hanson was Senior Manager of the World Economic Forum, in charge of Asian affairs, Information Communication Technologies member corporations and the New Asian Leaders Community. During this time he has developed an extensive experience and knowledge on the world’s economic, business and political scene and of its key players. Under his leadership, the World Economic Forum has expanded their presence in Asia and of ‘Davos’ Summits have evolved to facilitate the exchange of expertise between leaders in business, government, and civil society.

The Manor Group is a leading strategic advisory on long term scenarios related to globalization, systemic risk and business needs. Horasis our business partner on Asia is a visions community – together with clients and partners we explore, define, and implements trajectories of sustainable growth. Horasis hosts the annual China Europe Business Meeting – the foremost annual gathering of Chinese business leaders and their counterparts from Europe, North America and other parts of the world.

Furthermore Parvis Hanson has been working with many Governments from around the world such as Singapore, Australia, China, German, French, UK, Spain, Portugal, Russia, USA and the European Commission.

Parvis Hanson has addressed audiences at the World Economic Forum, and several high-level corporate and political events.

Don Moskaluk

Don Moskaluk

Don Moskaluk is a talented, visionary executive, an experienced leader in the development of systems and teams to support information technology. Leveraged business acumen to develop cost effective solutions providing business with information necessary to grow exponentially as well as work to synchronize the technology strategy with the business goals.

An accomplished business architect experienced in designing, developing and implementing cross-functional and enterprise-wide customized solution, including Credit Card Processing, Call Centre & VoIP, CRM, Inventory Control, Point of Sale, Data Warehousing and data mining, ERP, Sales, Marketing, Manufacturing, Logistics and Distribution. Solid leadership experience with responsibilities for all aspects of information systems and telecommunication. Demonstrated ability to use current technology in alignment with corporate strategies and goals. Adept at blending resources to produce timely, low-cost enterprise solutions as well as a long track record as a team player with strong organizational, analytical and communication skills.

Don began working for de Havilland Aircraft in 1984 after receiving a degree in Geography from Carleton University in Ottawa, Ontario Canada. During his career he has worked for various aircraft manufacturer such as de Havilland Aircraft, Boeing, and Bombardier. He started in the Marketing department where he developed his extensive computer and organization skills. Fusing these skills and the lust for marketing, he guided the desktop publishing revolution in the aircraft industry. As a result, the marketing department changed the way that it communicated with its clients.

Once successful, he moved his talents to the Information Systems department. He became a senior system administrator within a few years, not only understanding the technology but also the business of deploying, managing and using that technology to get financial benefits. He moved on to various other companies where he directed numerous Information departments. He has sat on various boards of directors for Financial and Non profit institutions. Having a desire for entrepreneurship, he started his own consulting firm. IBM contracted him as a consultant to assist the deployment of Year 2000 computer transition for the Provincial Government of Ontario. Returning to school he acquired a Master degree and Doctorate in Economics and Government from Ukrainian Free University in Munich. He has also provided infrastructure guidance for financial and other companies. He has managed several of the newest technology introductions such a video conferencing over IP, VoIP, wireless Mesh and IPTV. He has worked as a Managing Director for Digital Marketing firm N5R in which he exiled its profitability 4 fold and is working for Resolve Corporation provide Enterprise Solution Architecture.

Mark Dangelo, Managing Principal at Innovative Relevance

Mark Dangelo, Managing Principal at Innovative Relevance

Mark Dangelo is a respected global crisis innovator, remediation specialist, and strategist with extensive process, technology, and finance results. Possessing a diversified services and product background, Mark is a hands-on leader able to deliver sustainable problem-solving benefits under the most demanding of organizational conditions and constraints.

With international operational and delivery experience spanning 20 countries, Mark P. Dangelo has proven crisis remediation, risk management, and turnaround capabilities. As a renowned and comprehensively published individual with two books, in-depth industry reports, and over 150 papers, Mark is acclaimed as a results leader and innovator across multiple disciplines and industries. Furthermore, his CAR’s — challenges, actions, and results — have been prominently featured in trade journals, conferences, and search engines since 2001.

Underpinning his process, strategy, and technology foundation is a BS in Computer Science, studies in advanced mathematics, preparation for Series 7 and 63, and a MBA with a concentration in operations research and finance. As part of his globalization experience, Mark has been engaged by over 100 firms and governments during his 28 year career.

Mark has also spearheaded multi-year programs that surpassed $400 million, restructurings of nearly $1 billion, and outsourcing arrangements exceeding $1.2 billion. Mark’s varied background is highly unique in that he has created and funded several startups, led multi-national teams above 350, and had P&L responsibility beyond $100 million. Bottom line is that Mark is a pragmatic, diversified, and agile individual who excels in varied business sizes including the Fortune 100.

Mark has held prominent consulting positions with CSC, A.T. Kearney, Ernst &Young, Stanford Research Institute (SRI) Consulting, and his own private brand Innovative Relevance®

Download “CEE IT Outsourcing Review 2008″