The revolution in telecommunication and computing allows corporations to benefit from tapping low cost, high quality labor from around the world. As corporations embark on outsourcing initiatives to leverage these benefits, a question corporations often grapple with is: How much to outsource and offshore?

The answers vary by company and have not been static over time.

Business process outsourcing (BPO) continues to focus on transactional processing work. Yet this is slowly changing. In the 1990s BPO usually meant cherry-picking a couple of processes like accounts payable and payroll for outsourcing; today more and more buyers are adopting the mind-set that the only must-haves for retained back-office functions are policy and strategy.

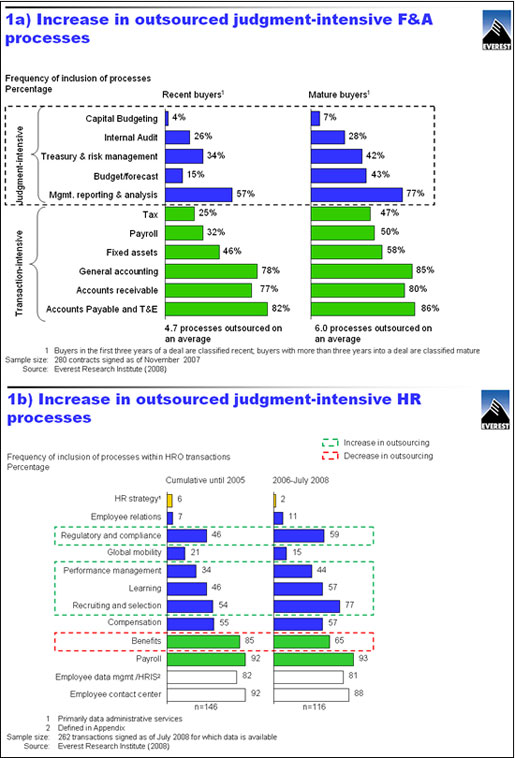

Exhibit one below provides two examples of increases in business process outsourcing (BPO). Exhibit 1a contrasts the scope of Finance and Accounting (FAO) services outsourced by buyers who have outsourced for less than three years with more mature buyers. As buyers mature, they expand the scope of outsourced services to include more judgment-intensive processes.

Exhibit 1b contrasts the scope of Human Resource (HR) services outsourced prior to 2006 with the scope of HR services outsourced after 2006. In the more recent deals we see a significant increase in the scope of judgment-intensive HR processes outsourced.

Exhibit One – How much buyers outsourced

How much work are buyers sending offshore?

In the early part of this decade, Everest Group helped a company outsource its U.S. accounting work. The buyer earmarked 50 percent of the work for India and moved the other half to a lower-cost location in the United States. Moving 50 percent of the accounting work to India required a lot of discussion on risks and risk mitigation to make key stakeholders comfortable enough to approve the move.

Today, such a solution would result in a very different discussion; everyone would ask why the company was sending only 50 percent of the outsourced work offshore. Today’s BPO agreements include a much more aggressive distribution of work between offshore and onshore.

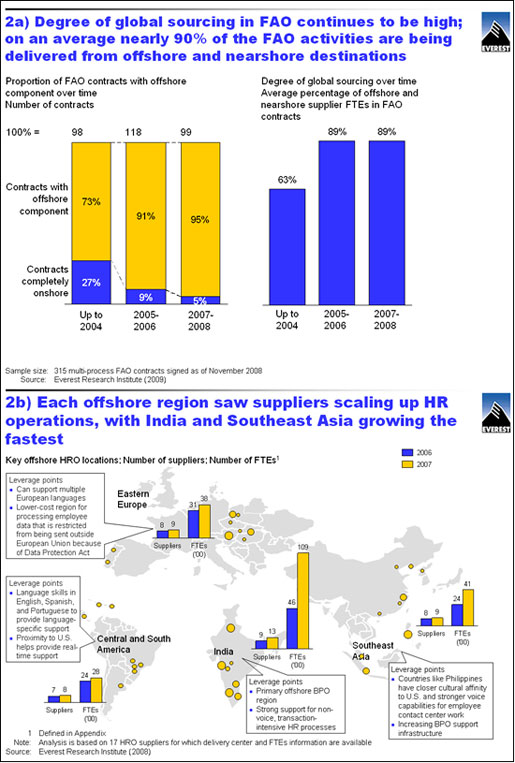

Exhibit 2 below shows the significant increase in BPO offshoring in the last f few years. Exhibit 2a shows that only 73 percent of FAO outsourcing agreements established prior to 2005 had an offshore component; today more than 95 percent do.

Even more striking is the percentage of outsourced work performed offshore. Prior to 2005, offshore suppliers performed approximately 63 percent of FAO; today that number is approximately 90 percent.

Exhibit 2b shows the dramatic expansion of HR service centers by BPO providers.

Exhibit 2 – How much BPO work is going offshore

There are a number of factors, both intrinsic and extrinsic, that have influenced this increase in offshoring.

Key extrinsic factors causing the expanded use of offshoring include:

The evolving maturity of the industry continues to address many if not all of the extrinsic factors. The industry has proved itself to be more robust and reliable than ever before. All of the above factors have reduced the risk perception, brought new buyers into the marketplace, and sent a higher proportion of services offshore.

The case is different with the intrinsic factors, which by nature are unique to every organization and thus may well hold the key to how much each company offshores.

The key intrinsic factors include:

A majority of the intrinsic factors deal with the degree of encapsulation of the business process. The better encapsulated a process is, the more readily it lends itself to a full-scope offshoring.

This discussion of extrinsic and intrinsic factors shows there are multiple facets to consider in trying to answer the “how much” question. There is no one-size-fits-all response. A structured assessment of these factors and other unique conditions helps organizations determine the appropriate service model and mix of offshore and onshore resources.

While the above discussion used Finance & Accounting and HR examples, the trends and factors are broadly applicable across the spectrum of BPO services buyers have outsourced.