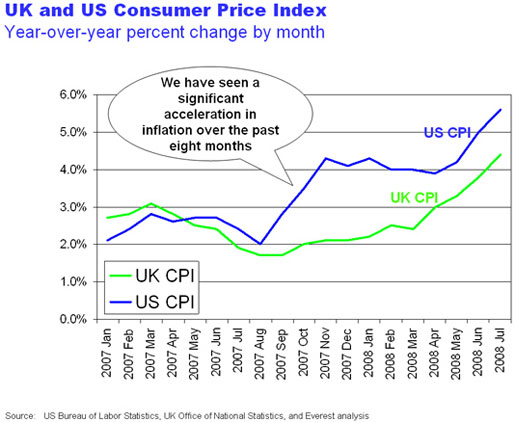

Much has been written about inflation in offshore locations, but what about inflation at home? After many years of moderate inflation in North America and Western Europe, it is now at a multi-year high, largely driven by higher commodity prices (see Figure 1). Existing outsourcing contracts, signed in the earlier era of stable inflation, may not be structured optimally for the current level of inflation. Both buyers and suppliers need to assess whether their contracts expose them to inflation risk.

Figure 1

Broadly, contracts fall into two categories: those that stipulate the supplier’s prices are inclusive of inflation and those that outline an inflation-linked price adjustment mechanism. In the case of the first, the supplier bears the inflation risk. In the second, the inflation risk belongs to the buyer. There are also an infinite number of hybrids between these two where there is a defined risk sharing between buyer and supplier. The degree of risk, however, depends on how the agreement designed the price adjustment mechanism.

The degree of risk borne by the buyer or the supplier typically depends upon three parameters used to define the inflation-linked adjustment mechanism:

The inflation index

The first factor, the inflation index, can either be a wage index (e.g., the Economic Cost Index) or a basket of goods index (e.g., CPI). Wage indices are more risky compared to basket of goods indices because by definition they are based upon a single variable, which makes them more volatile. A basket of goods index, by definition, is a more broad-based indicator of inflation because the rise in price of one commodity might be offset by the fall of another.

The relevant geography

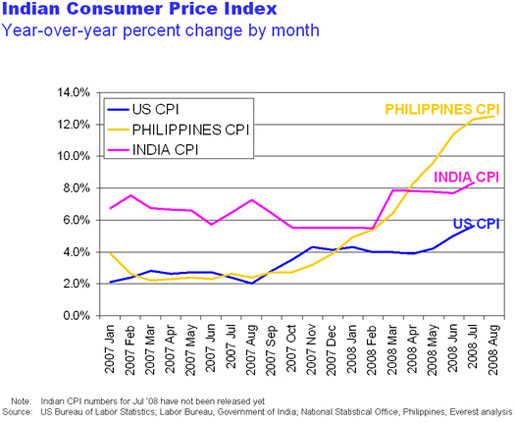

The second factor, the geography used for measuring inflation, can either be the service delivery geography or the service recipient geography. This parameter is important in offshoring contracts because service-delivery geographies, which are typically emerging economies, tend to have higher rates of inflation compared to service-recipient economies, which are typically developed economies (see Figure 2 below). The CPI in the Philippines is currently running at around 12 percent compared to approximately 5 percent in the United States.

The risk sharing

The third parameter, the agreed sharing of the inflation-linked increase, explicitly sets up how the buyer and supplier share risk. This parameter is typically based on the share of the supplier’s delivery cost structure, which it cannot hedge against inflation. Productivity increases are likely to offset a significant share of wage increases, in which case the supplier must bear the inflation risks for some of the wage cost portion of supplier’s cost structure. The supplier will also have some fixed costs that will not move with inflation for the duration of the outsourcing agreement.

Figure 2

Regardless of who holds the risk in the contract, inflation is a problem for both the buyer and the supplier. If contractually the supplier holds the risk, then the supplier is obligated to absorb the increase in input costs, thus reducing the account’s profitability. This disincents the supplier from investing in the account. There are a number of ways that a supplier can consider cutting back on services while remaining within the bounds of its contractual obligations.

As a buyer, you prefer that this not happen, and you especially don’t want this to happen without your input.

If contractually the buyer holds the risk, then the buyer is obligated to pay for the supplier’s increased cost of delivering services. In such a scenario, the buyer has two options. The buyer can pay the increased supplier charges and suffer a budget overrun or choose to scale back the volume of services consumed. Scaling back is likely to negatively impact end-user satisfaction as well as decrease supplier revenues. Either way, both buyer and supplier lose.

A collaborative approach between buyer and supplier is the key to finding a win-win solution. The buyer’s interest is to hold the line on the supplier’s prices while the supplier’s interest is to maintain account profitability and customer satisfaction. In order to achieve these objectives, both buyer and supplier need to collaborate to identify opportunities to reduce the delivery costs and risks.

Here’s how: