The IT market in Romania is slowly recovering. At the end of 2010 the market still remained in the area of uncertainly after a sharp decline in 2009 and some vague demand stabilisation in 2010. The market structure is changing. New players have appeared on the market. Is the bounce back possible in 2011?

The total value of the Romanian IT market declined in 2010 by 2.6% to approximately Ђ831m. Although the market contracted again, the level of decline was not that significant as a year earlier. Generally speaking in 2009-2010 the economic crisis in the country impacted private consumers and companies, which reduced IT budgets. Public IT spending also declined although the possibility to attract EU structural funds became a factor that was able to rescue part of the IT projects of Romanian authorities in 2010.

The hope that it would take a maximum of one year for the Romanian economy to overcome the crisis and that in 2010 the investments in IT would recover the growth has not happened. In 2010, there were however some growing niches and product groups in Romania including portable computers, servers, BI and CRM solutions, IT security software but these growing segments were not improving the entire market.

General investment perspectives in Romania and perspectives for the IT industry in the country in 2011 remain uncertain. The IT vendors that were interviewed by PMR related the recovery of the demand for IT products and services to the overall economic improvement. However, based on the most optimistic assessments, the recovery of the economic growth in Romania is expected chiefly as of the second half of 2011, and in the whole of 2011 will not exceed 1.5%. This means that the more significant growth in the demand for IT will only happen in 2012, due to the usual six-month lag between economic and investment growth.

All in all PMR expects that the demand for IT products and services in Romania to show a modest 5.5% growth in 2011, to be followed by the stable increase of IT spending in the country over the next few years. However, average growth in 2011-2012 will not exceed 7%, which is quite unimpressive in comparison with the double-digit market expansion in 2005-2008. It can be added that in the next few years, the development of the IT market in Romania will be based mostly on the internal resources of the economy. Also, the phenomenon of a consumption boom financed by affordable loans from foreign banks in our opinion is not going to be repeated.

PMR also predicts that Romanian IT companies will continue to look at the possibility of offering software development outsourcing services. Local providers including Asesoft, Ness Technologies, Scop Computers, Siveco and S&T have already started to explore the nearby export markets of Bulgaria, Hungary, Macedonia, Moldova and Serbia.

IT distribution shake-up

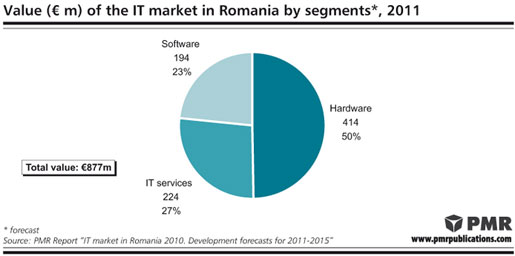

The share of hardware in the total value of the Romanian IT market dropped down significantly in 2009 and 2010, which is explained by the massive reduction of IT spending by individuals and SOHO users. These customers are buying mainly hardware and spending significantly less on software and services. The decline in computer hardware sales in 2009 and 2010 damaged the business of IT distributors and retailers. The crisis caused both retailers and customers to cut expenses and as a result the number of computer outlets was reduced by many retail chains while the sales via the internet in Romania were quickly taking over the share of off-line retail. The decline of the demand on the segments of computer hardware also caused prices to drop.

Several of the retailers, including eMag, Tornado Systems, Flanco and Scop Computers were acquired by the competitors or partners. The UltraPro retail chain announced bankruptcy and stopped the business. The main executor of M&A deals in 2009 and 2010 was Asesoft Distribution. This actually became the first case in the country when the distribution and retail of computer hardware created a vertically integrated structure.

“It is worth mentioning that a more visible trend is also an interest of the Romanian IT distribution market from regional players active in other Central and Eastern European countries. At the end of 2010 the Polish major IT wholesaler, ABC Data, acquired Scop Computers, paying Ђ5.0m for the 51% stake” – Pawel Olszynka, a PMR analyst, comments. There have been also rumours that another Polish leading IT company, Asseco, is interested in more acquisitions in Romania. It is difficult to forecast M&A activities in the next few years; however, the growing interest in the Romanian market from abroad, including China, Russia and the European Union, could lead to some acquisitions as the fastest way to establish a market presence in the country.

This press release is based on information contained in the latest PMR report entitled “IT market in Romania 2010. Development forecasts for 2011-2015”.

About PMR

PMR (www.pmrcorporate.com) is a British-American company providing market information, advice and services to international businesses interested in Central and Eastern European countries as well as other emerging markets. PMR’s key areas of operation include business publications (through PMR Publications), consultancy (through PMR Consulting) and market research (through PMR Research). Being present on the market since 1995, employing highly skilled staff, offering high international standards in projects and publications, providing one of most frequently visited and top-ranked websites, PMR is one of the largest companies of its type in the region.