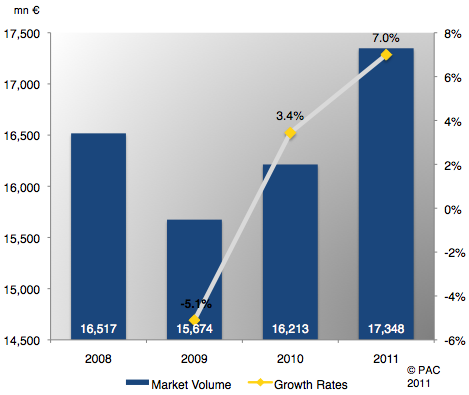

Bucharest – March 01, 2011 - The year 2010 has seen signs of recovery in the software and IT services (SITS) market in Eastern Europe, but the trend has not yet been completely confirmed in all the countries. With a total market volume of EUR 16.21 bn last year, the regional SITS market is still way below the historical high of 2008, but Pierre Audoin Consultants (PAC) expects the market to exceed that record high at the end of 2011.

Despite the high growth rates during the boom period, the current EE markets show a very interesting phenomenon. The IT suppliers are now very prone to lowering their rates and margins under the customers’ or competitors’ pressure. At the same time, the clients have quickly “discovered” that IT is not really completely critical to their business, so they seem keen to keep IT budgets relatively low and to take the risk of lower quality for a much better price.

As the private sector takes a back seat, Eugen Schwab, Managing Director PAC Eastern Europe, considers that “The public sector has a key role in the market’s dynamics, the Government’s IT strategies and allocated budgets are, at least in 2010-2011, more important than the 22.6% share of the public sector in the total market of software and IT services”. However, the main issue related to public IT projects is the one of the players’ selection and the factors generating the demand; in most of the EE markets, IT players with strong lobbying power generate the IT projects tailored to their competences or to their opportunistic differentiators. At the same time, when the need in a public institution is more concrete, the tender has very often “strange criteria” with which the “preferred supplier” wins even if, from a pragmatic perspective, it is not the best positioned to deliver the fastest and highest quality.

Looking at the commercial sector, PAC forecasts that banking and the public sector are going to be the most dynamic in the region, fuelled by projects around applications (the implementation of standard solutions or custom software development), but also by several outsourcing contracts (mainly infrastructure-related, but also related to hosting, BPO, or application management).

Several trends have become apparent in the purchasing behaviour of the East European commercial sector for IT services. These include the lower average value of an IT contract, the lower average volume of work by contract, the higher interest in increasing in-house teams, longer negotiation cycles. Based on this and the reluctance to very large IT investments, the commercial sector has proven to be a very challenging one for the IT providers. However, the relatively normal rules that apply to the projects in the private sector generate a healthy demand in Eastern Europe. Also, the strong influence of the multinationals, leading most of the sectors in each of the region’s economies, represents the main factor for innovation in IT, real competition and evolution of the local competencies.

Regarding the main players, the influence of large multinationals is expected to remain low in Russia and Turkey, but their market share will grow in countries like the Czech Republic, Poland, Hungary, Slovakia or Romania.

The “local heroes”, the local IT players that succeed in being among the ten main providers in their niche, are increasingly interested in finding new investors for complete or partial takeovers. This situation has been created due to several factors such as lack of adequate financial resources needed to remain up-to-date in terms of technology, the increasingly difficult penetration of international accounts only with a local “door” or the strong desire amongst the owners to cash out of the businesses, to pay back historical debts (private ones or the ones related to the company’s investments) and to look for other investment areas (green energy, financial speculation, art, real estate, …). At the same time, the valuation of local IT companies is reasonable today and, combined with the market potential, should represent a good opportunity for expanding in an underdeveloped region (increasing market share, entering new accounts, adding more good teams, covering more markets).

PAC remains relatively optimistic about the growth of the IT markets in Eastern Europe during the next couple of years, but several questions remain and could diminish strongly the year-end performance in 2011 compared to the previous year.

About Pierre Audoin Consultants (PAC): PAC is a global market research and strategic consulting firm for the Software and IT Services Industry. PAC helps IT vendors, CIOs, consultancies and investment firms by delivering analysis and advice to address a range of growth, technology, financial and operational issues.

Our 30+-year heritage in Europe – combined with our US presence and worldwide resources – forms the foundation of our ability to deliver in-depth knowledge of local IT markets, anywhere. We employ structured methodologies – undertaking thousands of annual face-to-face interviews on both the buy and sell side of the market, as well as a bottom-up, top-down approach – to leverage our research effectively.

PAC publishes a wide range of off-the-shelf and customized market reports – including our best-selling SITSI® program – in addition to our suite of strategic consulting and market planning services. Over 160 professionals in 16 offices – across all continents – are delivering the insight that can make a difference to your business.