The following trends were observed in all countries of the CEE region:

Three main clusters of countries with similar situations in the market can be defined and categorized.

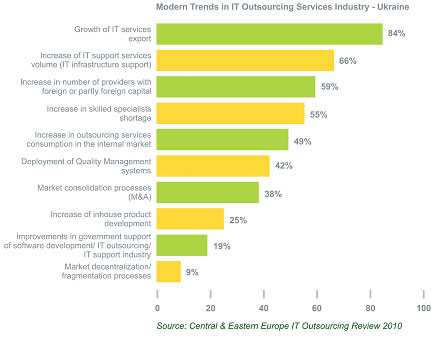

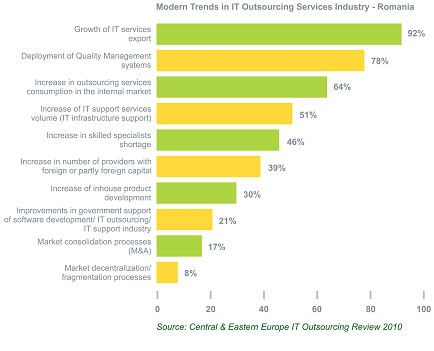

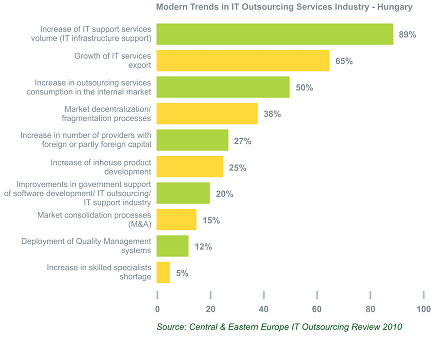

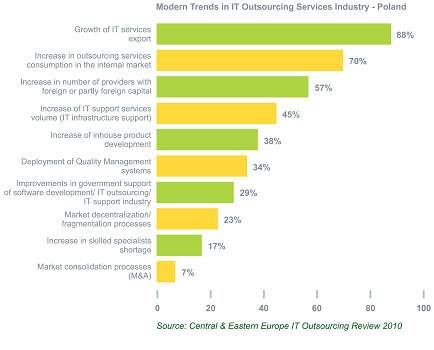

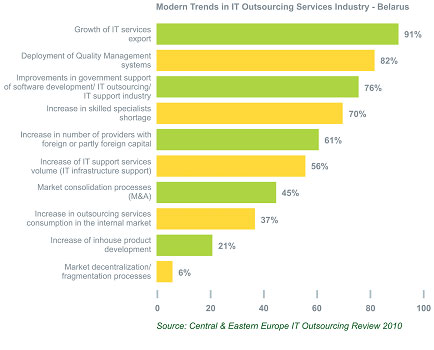

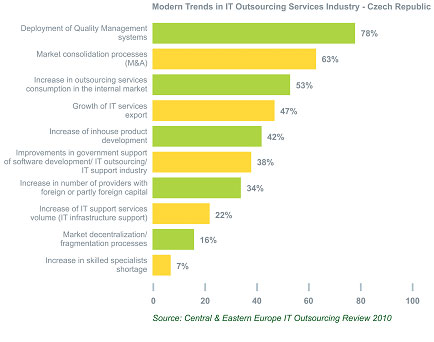

The first cluster represents the leading countries in the region. They are Ukraine, Romania, Hungary, Poland, Belarus and the Czech Republic. The common trends in this cluster include growing market volumes and increasing volumes of services exported; growth in the consumption of outsourcing services in the internal market; growth in their share of IT support services (IT infrastructure support); and service providers that are improving their technologic processes and quality management systems.

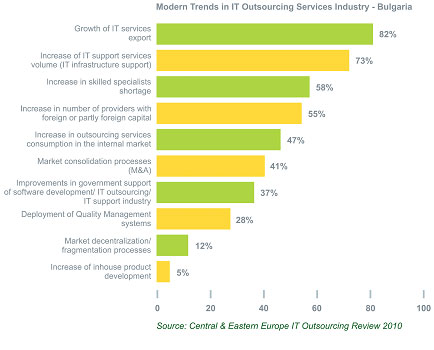

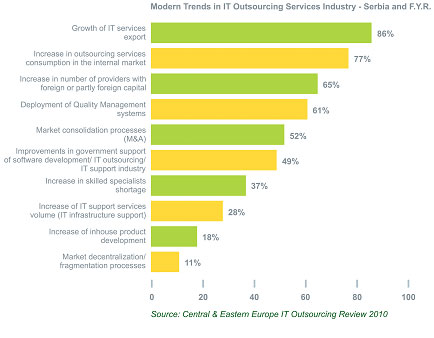

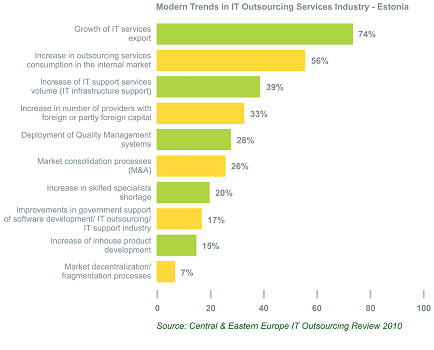

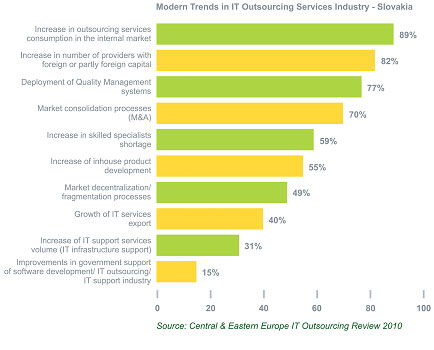

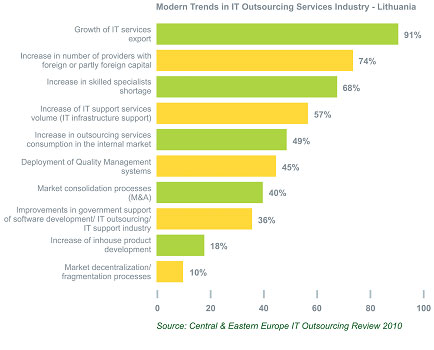

The second cluster includes countries with developing markets for IT outsourcing and software development services. They include Bulgaria, Serbia, F.Y.R., Estonia, Slovakia and Lithuania. These countries share commonalities such as similar growth in IT services exports; increased outsourcing services consumption in the internal market; and growth in the number of providers with foreign capital or partly funded by foreign capital. The trend of increasing skilled specialists in these countries is impressive, given the shortages of specialists elsewhere.

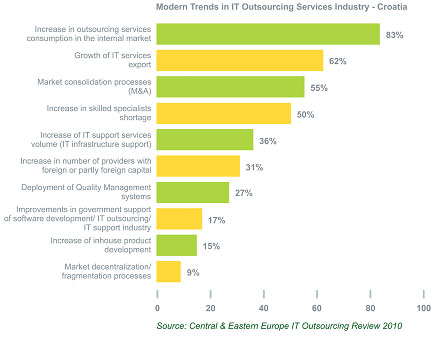

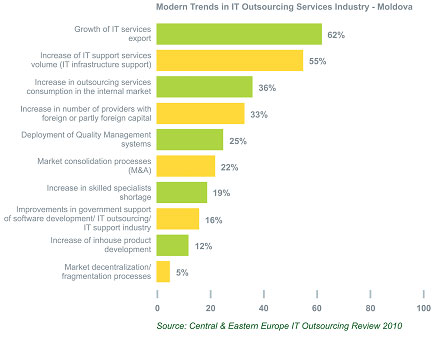

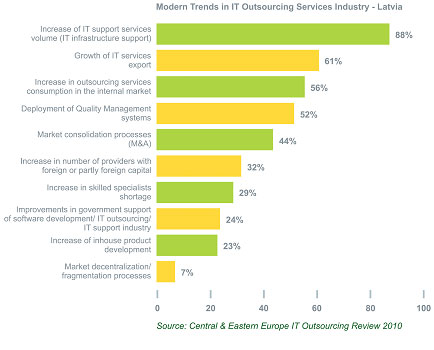

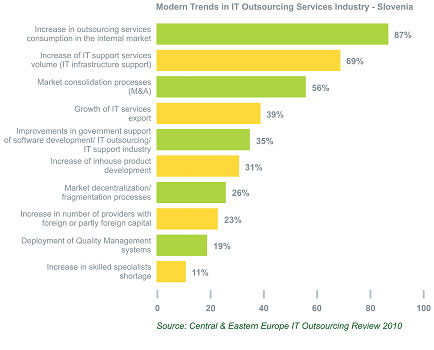

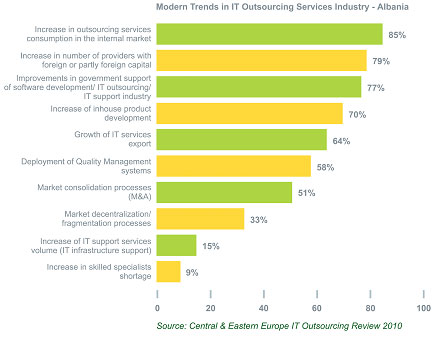

The third cluster reflects countries with recently established markets. These countries include Croatia, Moldova, Latvia, Slovenia and Albania. These are relatively small countries in the CEE region and they represent the smallest markets. This cluster mirrors the trends in the other two clusters such as growth in IT services exports; increased outsourcing services consumption in the internal market; and growth in the share of IT support services (IT infrastructure support). However, this cluster exhibits one distinct trend – market consolidation processes (mergers & acquisitions) which illustrates the immaturity of the markets in these countries.

Note: Figures on the predominant trends in the countries of the CEE region are based only on the results of the online survey. The assessments were made based on 220 survey responses. When defining the trends, respondents chose an arbitrary number of items from the variants offered in the online survey form.

Figure 18. Modern Trends in IT Outsourcing Services Industry – Ukraine

Figure 19. Modern Trends in IT Outsourcing Services Industry – Romania

Figure 20. Modern Trends in IT Outsourcing Services Industry – Hungary

Figure 21. Modern Trends in IT Outsourcing Services Industry – Poland

Figure 22. Modern Trends in IT Outsourcing Services Industry – Belarus

Figure 23. Modern Trends in IT Outsourcing Services Industry – Bulgaria

Figure 24. Modern Trends in IT Outsourcing Services Industry – Czech Republic

Figure 25. Modern Trends in IT Outsourcing Services Industry – Serbia and F.Y.R.

Figure 26. Modern Trends in IT Outsourcing Services Industry – Estonia

Figure 27. Modern Trends in IT Outsourcing Services Industry – Slovakia

Figure 28. Modern Trends in IT Outsourcing Services Industry – Lithuania

Figure 29. Modern Trends in IT Outsourcing Services Industry – Croatia

Figure 30. Modern Trends in IT Outsourcing Services Industry – Moldova

Figure 31. Modern Trends in IT Outsourcing Services Industry – Latvia

Figure 32. Modern Trends in IT Outsourcing Services Industry – Slovenia

Figure 33. Modern Trends in IT Outsourcing Services Industry – Albania