Twenty years ago, when buyers were entering outsourcing agreements for the first time and the market was young, it was unusual for an outsourcing agreement to run its full term. In today’s market, it has become the norm for outsourcing contracts to do so. The drivers for this change are market maturation and shortened contract length.

Market maturation

In today’s market, many buyers have been through the process before and are renegotiating existing outsourcing contracts or entering new agreements with the lessons learned from previous outsourced functions. Additionally, buyers are drawing on the experience of third-party advisors, such as the Everest Group, which bring years of experience and current market knowledge on pricing, supplier capabilities, contract terms, and offshore locations.

A great deal of standardization has also evolved. In those early outsourcing deals, there was considerable improvisation and experimentation in the market for lack of examples to follow. Today, many aspects of an outsourcing transaction have become standardized, and best practices have emerged. The combination of proven best practices and experienced advisors makes it easier now to get things done right the first time.

Therefore, buyers and suppliers design contracts better, and suppliers are more responsive to buyers’ changing needs with flexible pricing, continuous improvement in service levels, and mechanisms to address acquisitions, divestitures, growth, and changes in the economy. This flexibility means that buyers and suppliers can often adapt contracts without renegotiation.

Contract length

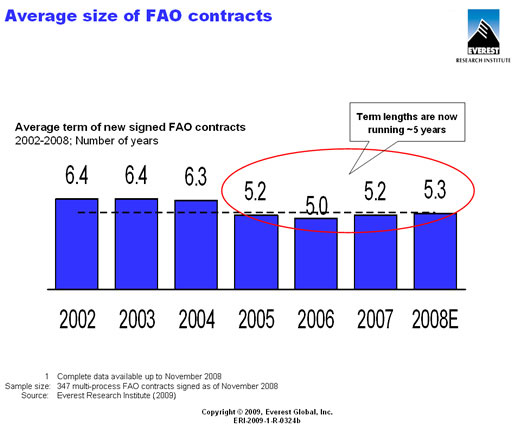

Perhaps the most significant driver for outsourcing contracts running full term is that the average contract term length has shortened from an average of seven to ten years to an average of five years. Shorter contract terms are the primary driver for outsourcing contracts running their full course.

Exhibit 1

During a seven- to ten-year contract term, buyer leadership and corporate objectives change, technology evolves, and the buyer organization grows faster or slower than originally planned. These unforeseen yet inevitable changes over the long-term horizons make an evaluation of strategic relationships necessary.

During that time, the supplier landscape evolves as well. Unit prices tend to decrease as services become commoditized, skill sets evolve, and the labor pool education level increases. Delivery innovations such as streamlined workflow processes and technological advancements drive efficiencies and process improvement.

Delivery locations change over time as well. Political stability and currency risk change as well as public perceptions of these factors. India has performed on the global scale for a decade now, but after the November 2008 attacks on Mumbai, a number of buyers began to consider delivery locations outside of India in order to mitigate concentration risk through diversification.

Macroeconomic changes also move industry trends, financial considerations, and technology evolution. With evolving compliance in financial reporting for all industries plus new information security requirements in healthcare, defense, and financial services, compliance, security, and reporting have become paramount supplier capabilities.

Policy changes drive the industry landscape as well. With U.S. presidential elections every four years, each incoming administration brings a change in regulatory focus and guidelines.

For example, in healthcare, the stimulus funding and mandate to adopt electronic health records by 2016 has driven supplier activity to provide not only the necessary software but also up-front financing, grant writing, and general guidance on standards and policies.

Similarly, pending energy legislation will drive corporations to reduce their carbon emissions, putting an emphasis on green IT, low-carbon supply chains, and stricter reporting.

Congress has discussed the healthcare and energy legislation for years, but the standards and guidelines it is writing now will drive supplier ingenuity and advisory activity to guide buyers on how to respond.

Shorter contracts are better suited for the regulatory cycle. Economic cycles tend to be five to seven years, and accelerated technology changes beyond anyone’s imagination have occurred in the past decade. How could any 10-year contract plan for and survive these changes?

Early renewals

It is important to note that some shorter contracts do still end early.

One example is when buyers are so happy with their supplier relationship that they renew early to include changes in scope that reflect changing buyer circumstances or to clarify pricing to realign incentives. Kathleen Goolsby’s February 2009 Outsourcing Journal article on this topic[ Study Reveals Key Factors in Decisions for Early Renewal of Outsourcing Contracts] cites the top qualities in contracts renewed early. They usually include flexibility, honesty/integrity, feeling like both companies are one organization, performing with excellence beyond requirements, customer focus, and being proactive.

Although the original contract has technically ended ahead of term, the early renewal with the incumbent supplier means no termination fees or transition-out process. The two parties may need to redefine the contract, but the relationship has evolved successfully.

On the other hand, some contracts do still end early to terminate the relationship. A common reason for early termination is a leadership change in an executive team that does not believe in outsourcing and therefore repatriates services.

End-of-term strategies

With more contracts running their full term, end-of-term strategies become paramount. Buyers should begin examining strategic objectives and market comparables 24 months prior to contract expiration to begin the process of building the fact base necessary to determine whether to renegotiate with the incumbent supplier or re-compete the work with a new set of suppliers.

Buyers should ask themselves three questions when approaching their end of term :

Buyers can approach the first question (how has the market changed) with the following framework:

The second question (a comparison to the market) is an area that the Everest Group routinely addresses by benchmarking pricing, service levels, and contract terms.

Buyers can address the third question (how to expand value) with a comprehensive end-of-term strategy exercise. The Everest Group has refined an end-of-term strategy methodology with a focus on value. See [End-of-Term Strategy: It's Never Too Early to Begin] for more information.

Your existing outsourcing contracts are likely to come to a natural end of term. Don’t pass up this opportunity to explore all of your options. Start early, refresh your knowledge of the market, evaluate your supplier, consider fine-tuning the scope of services, get current market pricing, and learn about new market trends and service delivery locations. But the most important lesson is to start early.