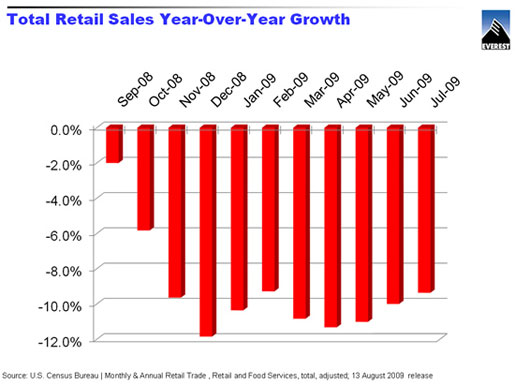

This economy has taken the wind out of retail sails (sales). According to the U.S. Census Bureau, retail sales year-on-year dropped 0.4 percent in 2008, the largest decrease since the Bureau began tracking sales data. We hear much in the news about “green shoots,” but it’s hard to find anything but red in the retail sales data.

Exhibit 1 — Total retail sales growth

And the storm hit every major discretionary goods category with apparel, sporting goods, furniture, and building materials diving the most drastically. This ugly pattern started in the middle of last year and hasn’t really gotten better. Consumer research suggests the current recession will have a longlasting effect on consumer behavior; few expect consumer spending will rebound to previous levels after the economy recovers.

Naturally, this puts extreme pressure on gross margins due to the fall-off in demand. Retailers, naturally, moved to staunch the bleeding. They cut capital programs, prices, and payroll.

Unfortunately, these changes provide only temporary relief. They also can be dangerous to the long-term health of the organization since the cuts impact the strategic plans of the organization. Retailers can’t move into new markets or capture greater market share. These actions are akin to eating one’s seed corn.

A more sustainable path to survival

There is one long-term action retailers can take to reduce their cost structures: offshore outsourcing. Offshoring allows retailers to afford to get the work done properly instead of loading more and more work on an ever-shrinking employee base after repeated rounds of head-count cuts.

Of course, outsourcing is not new to retailing. JCPenny was a pioneer in 1998. Today, retailers such as Abercrombie & Fitch, 7-Eleven, Office Depot, even Wal-Mart have adopted this business model.

What are retailers actually outsourcing? Our research shows 74 percent are outsourcing IT, including data and call center technology, network, or applications. Customer Relationship Management (CRM) is a distant second at 12 percent.

Lately, however, we have seen acceleration into finance and accounting, human resources, CRM, even procurement outsourcing. We predict retailers will continue to increase their BPO activities in response to the current economic environment.

Why will offshoring help retailers? Selling, general, and administrative (SG&A) costs as a percentage of total costs has historically hovered around 20 percent. Fortunately, these are the functions that have a mature outsourcing solution.

Offshoring SG&A functions is the most effective way to predictably improve the bottom line. We estimate retailers can save up to 20 percent in HR and up to 35 percent in IT ADM and CRM if they outsource to a supplier with an offshore component. (The savings will never be 100 percent because the retailer will always have a retained core group of people in the IT department, HR department, etc.)

Why offshoring is a good solution now

Offshoring offers many long-term advantages:

Offshoring’s challenges

No one says this shift will be easy. It requires process reengineering and cultural and organizational changes. After implementing outsourcing, the operating model also becomes more complex because the offshore supplier will have service centers in different corners of the globe creating a network of service delivery locations in multiple time zones.

Then there’s the question of mitigating risk associated with attaining the desired cost reductions. Steve Krumholz, senior vice president of Blockbuster, advises, “Don’t underestimate the amount of planning, effort, time, and change you are going to have to deal with.” He says Blockbuster was clear about its outsourcing goal: it wanted to cut costs while maintaining or improving the level of service to its customers.

Blockbuster created an executive committee including the CEO, CFO, and general counsel to obtain executive buy-in. Then it established a steering committee for each of the outsourcing initiatives to ensure “we kept expectations in line with the results we were obtaining.” On the other hand, “Don’t be surprised if you have to make more changes than you anticipated as you work through the process,” says Krumholz.

He says creating a strong program management office, developing robust governance models, and investing in change management programs are a must.

Krumholz says change management programs have to consider the needs of every stakeholder group including customers, employees, shareholders, and regulators. He points out that retailers must consider the changes they’ll have to make in their organizations once they outsource. The retained employees have to learn “to manage outcomes rather than activities.”

Stakeholders need to understand that some start-up costs can be significant. “You have to manage the short-term costs in order to realize the long-term benefits,” he notes.

What if you have already offshored?

Well, you’re not done. You can obtain additional savings from your existing outsourcing agreements. Our advice is to assess your options:

In today’s economic environment, outsourcing buyers should ask this question: Are there ways to modify the existing outsourcing relationship to drive additional value?