Though to a limited extent, the strain of the economic crisis is felt by the IT industry as well. After the release of considerably poorer macroeconomic data for the Central European region, a need arose to revise forecasts for the IT market. Most IT companies will find it extremely hard to expand in 2009.

Despite the fact that the IT industry is relatively less affected by the economic crisis compared to other sectors of the economy, the economic slowdown will shape the financial results generated by IT businesses as well. In the coming two years, the IT markets across the entire Central Europe will see a clear deceleration of the dynamic growth seen in the previous years; in selected cases, we can even expect declines in the market value.

The main driving force behind these developments is the anticipated recession in the economy, which will affect expenditure of businesses and retail customers. The IT industry will be hit by many factors, including reduced capital expenditure of the financial sector, which is a strategic partner to the IT industry. However, prospects for individual countries concerning IT expenditure, the economic situation and macroeconomic forecasts are greatly varied.

According to PMR, a research and consulting company, in 2009, the cumulative value of the IT market comprising three largest countries in Central Europe (Russia, Ukraine and Poland) will decline by 10.5% to ca. Ђ22bn.

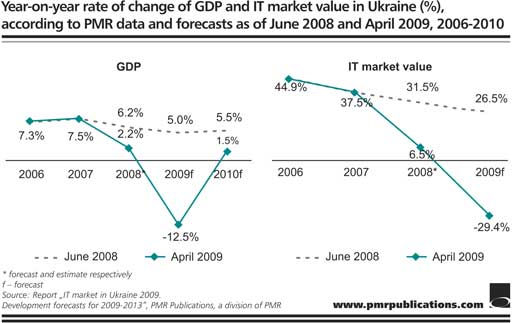

The situation of IT companies operating in Ukraine is currently the hardest. In terms of the impact of the recession, Ukraine is the hardest-hit country in the region. GDP growth forecasts were trimmed from a growth of ca. 0.5% to a massive decline reaching 10-15% just from the beginning of 2009. The likelihood of further deterioration in the market situation cannot be ruled out, especially that politics and the October 2009 presidential elections will be the dominating themes in the current year, with the economy forced into the background.

“Opinions of the largest IT companies present in Ukraine, which PMR surveyed at the beginning of 2009, are divided into those before and after the slump of the market in Q4 2008. It was at that time that sales of some suppliers, especially those of hardware distributors, fell by up to a half in year on year terms, while the final quarter of the year was usually the time of record-breaking results. In 2009, the value of Ukraine’s IT market may decline even by one-third, assuming that GDP does not fall by more than 10-15%” – comments Pawel Olszynka, PMR analyst.

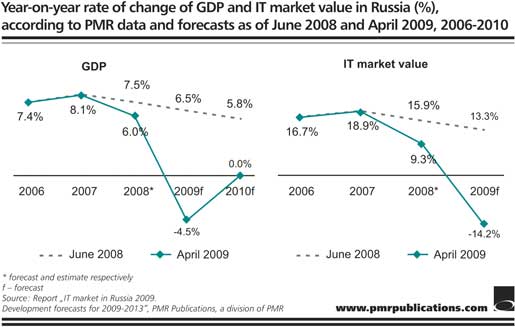

The value of the Russian market, which is the largest in the region, will also decline this year. According to PMR forecasts, year-on-year growth will be ca. -14%. In the past several months, the largest IT companies moved to reduce headcount in preparation for expected declines in demand for IT solutions in the wake of the economic slowdown. Primarily, consumer spending on hardware is expected to fall, also due to the strengthening of the US dollar and the upward pressure on prices. Reduced demand will be particularly hard felt by manufacturers and distributors, whose financial results were following a strong upward trend during the past two years of the boom in the computer and consumer electronics market.

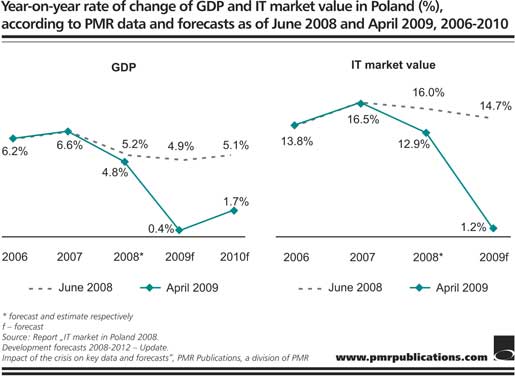

Forecasts for the Polish market have been revised as well, though as for now PMR predicts that the most likely scenario is a minimal, one-digit growth rate of the market’s value in the coming two years.

In 2008, the average annual GDP growth rate in 2009-2012 which we applied to generate development forecasts for the IT market in Poland was presumed to be around 5.3%. Now, PMR is leaning towards the view that GDP growth will not be higher than 3%. More pessimistic forecasts are also derived for gross fixed capital formation in the economy. In May 2008, PMR expected growth of around 10-12% for the following two years, while now PMR estimates that a negative growth rate is possible in the current year.

The majority of large IT enterprises declare that they have been spared the impact of the economic slowdown in Poland and expect positive results for 2009. In particular, this refers to software suppliers and providers of IT services, which frequently operate on the basis of long-term contracts. However, hardware distributors have a bleaker outlook for the development of the IT market in the coming year.

And it is in the case of the hardware distribution sector that PMR sees the clearest difference between its forecasts formulated in mid-2008 and the present situation. Already in 2008 we were dealing with a marked decline in sales of desktops and VDUs, especially in the final months of the year. Decreased demand for desktops and VDUs was accompanied by higher prices of imported hardware driven by a strengthening US dollar. As a result, suppliers were forced to squeeze their margins even further, although they were already very low, or to offer hardware at higher prices, which had an additional impact on sales figures. Declines in the desktop segment were partially counterbalanced by the growing sales of laptops, whose proportion in total sales of computers in Poland significantly is well above 50%.

The objective for hardware suppliers in 2009 will be to minimise losses. Hardware replacement cycles will be significantly lengthened during the crisis. Cost-conscious business customers reducing operating costs will be interested in deferring replacement as much as possible. PMR also expects greater popularity of energy-saving and virtualising technologies.

This press release is based on information derived from three reports published by PMR in 2009:

You are welcome to contact PMR analyst:

Pawel Olszynka, Head IT & Telecoms Analyst

tel. /48/ 12 618 90 61

e-mail: pawel.olszynka@pmrpublications.com

For more information on the report please contact:

Marketing Department:

tel. /48/ 12 618 90 00

e-mail: marketing@pmrcorporate.com

About PMR

PMR Publications (www.pmrpublications.com) is a division of PMR, a company providing market information, advice and services to international businesses interested in Central and Eastern European countries and other emerging markets. PMR key areas of operation include market research (through PMR Research), consultancy (through PMR Consulting) and business publications (through PMR Publications). With over 13 years of experience, highly skilled international staff and coverage of over 20 countries, PMR is one of the largest companies of its type in the region.