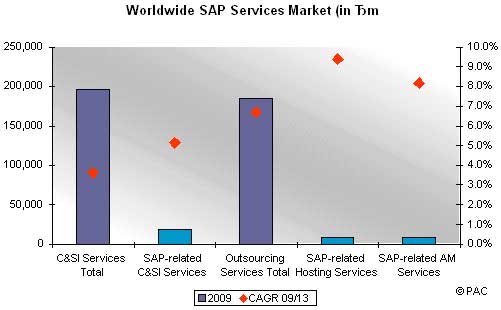

Despite the continued uncertainty of the worldwide economic situation, Pierre Audoin Consultants (PAC) ventures to forecast the development of SAP-related services in 30 countries around the world. The results show that SAP services continue to develop more so in the consulting & systems integration (C&SI) and outsourcing space than in any other IT services segment. However, the analyses within the framework of PAC’s global “SAP Services Research Program” also indicates that development varies significantly depending on the country – an indicator of how locally oriented the SAP business has been, especially set against the backdrop of ongoing globalization.

Munich, May 15, 2009 – The cloudy economic forecasts in all regions of the world have dampened the demand for SAP-related services. While SAP AG posted a sharp fall in its license business in Q1/2009, which could have been compensated by increasing maintenance revenues, the consulting business developed negatively ( 6%).

“Large-scale first implementations are virtually nowhere to be found anymore given the current market situation,” says Tobias Ortwein, Senior Vice President at PAC in Munich. “This is also felt by SAP Consulting, which actually has a good position in the market.”

So, what are the reasons for the positive forecasts concerning SAP services in contrast to other IT services segments? At times when cost reduction and efficiency increase are spelled in capital letters, projects aiming at process optimization and consolidation come to the forefront. Across countries, the means of standardization is increasingly employed. In many countries, SAP has developed into this very standard over the years. Another issue is the upgrade topic. Even if the functional and strategic upgrades have been addressed with reluctance, nevertheless, combined with the technical upgrades, they still stimulate demand. Apart from that, we can observe that with country-specific variations, the classic “bread-and-butter” business, i.e. the operational management and further development of the SAP systems have not yet been as affected by the drop in demand as the aforementioned large-scale projects. This is specific to the SAP services environment since numerous large companies belong to those customers that have limited potential for savings in running operations within complex SAP system landscapes if they do not invest in further large-scale harmonization and consolidation.

Nonetheless, the market for SAP project services has been impacted by the economic crisis. PAC expects a slight growth (+1.5%) of SAP-related C&SI services only for the APAC (Asia Pacific) region this year, while the “Americas” will be hit hardest with a decline of more than 4%. Europe, Middle East & Africa (EMEA) fares better with a decline of 2,5%. Given all this negative growth, one must not forget that project volume is not only removed from the market but it is also accompanied by price reduction.

One of the topics considered a strong hold in 2009 with regard to market potential is Business Intelligence (BI).

“However, investment in a BI project does not necessarily mean a solution from SAP’s BusinessObjects product line will be used,” says Peter Russo, Senior Consultant at PAC in New York.

The reason is that BusinessObjects can be integrated in other SAP solutions very well, however, it is not yet integrated to a crucial degree as to outpace other manufacturers’ BI products. Nevertheless, the BusinessObjects topic can be considered a good opportunity for services suppliers since often only small-scale pilot projects with a focus on short-term ROI are launched first, and if successful, lead to large roll-outs.

The markets for SAP Outsourcing, however, are segments that could benefit from the gloomy economic situation. This applies to SAP Hosting, as well as for SAP Application Management (AM). But this has to be viewed from a different perspective: both segments continue to be exposed to high price pressure, especially now. This can above all be noticed with renewals of existing contracts. For customers, SAP Hosting and AM services have become mainly commodity services. As a result, providers become exchangeable, and a differentiation will only be possible on a price or innovative price-and-billing-model basis. All large providers, such as IBM, EDS/HP and Accenture are facing these requirements with involving off- and nearshore resources to a greater extent, combined with an increasing flexibility of services through innovative on-demand or dynamic-services models, as in the case with T-Systems.

So, the growth expectations for SAP Outsourcing are positive for all regions – even in the short term and in the current market situation. However, PAC expects significantly lower growth this year in the “Americas” than in other regions. Particularly the very mature markets of USA and Canada show less dynamism, while Latin America is a growth driver but its contribution has to be put into perspective due to its low volume. The EMEA region is split into two camps: the comparably mature markets in Western Europe, which can definitely reach growth rates of 8-9%, and the remaining countries with even less mature outsourcing markets and forecast growth rates around 15%+. The APAC region, however, is even more polarized with e.g. Japan and Australia where we expect growth of 7-8%, as well as the engines for growth, China and India, which we deem capable of achieving a CAGR (compound annual growth rate) of just under 30% by 2013.

SAP Outsourcing is therefore more than ever a possibility for customers to optimize their cost structures and for service suppliers a business area with interesting potential.

“With the offshore ratio in the SAP services environment continually growing, it is becoming increasingly important to have well integrated global delivery capabilities,” comments Klaus Holzhauser, Director at PAC in Munich.

What will be most exciting in the future is the development of the “transformational outsourcing” approach in the SAP environment.

“In order for SAP service suppliers to implement this concept, they have to have a closely interlocked implementation concept of SAP consulting (business, process & technology) and SAP management (SAP Outsourcing). This was not the case in the past…” says Tobias Ortwein. “Only when you are able to estimate if a lower number of different platforms is sufficient or if the sales process in Japan is actually different than in Australia, and if you draw the appropriate consequences for IT (“transformation”), can this outsourcing concept apply.”

PAC’s “SAP Services Research Program” includes various modules from reports and analyses on the SAP Services topic and covers SAP-related consulting & SI (C&SI) as well as outsourcing services in 30 countries, three regions as well as from a global perspective. It is our goal to support IT decision makers and IT providers in the development and implementation of a successful strategy by helping them better understand the market, their competitors, and end-user behavior.

2009 the program comprises the following five report types:

The modular structure of the program provides us with a high degree of flexibility in order to create bundled offers in line with our customers’ requirements. Depending on the geographic coverage or the depth of analysis, our services portfolio contains products from 1,200 EUR to packages up to 120,000 EUR.

For more information on the various analyses available on the global SAP services market at Pierre Audoin Consultants (PAC), please contact Tobias Ortwein.

About Pierre Audoin Consultants (PAC): PAC is a global market research and strategic consulting firm for the Software and IT Services Industry (SITSI). PAC helps IT vendors, CIOs, consultancies and investment firms by delivering analysis and advice to address a range of growth, technology, financial and operational issues.

Our 30+-year heritage in Europe – combined with our US presence and worldwide resources – forms the foundation of our ability to deliver in-depth knowledge of local IT markets, anywhere. We employ structured methodologies – undertaking thousands of annual face-to-face interviews on both the buy and sell side of the market, as well as a bottom-up, top-down approach – to leverage our research effectively.

PAC publishes a wide range of off-the-shelf and customized market reports – including our best-selling SITSI® program – in addition to our suite of strategic consulting and market planning services. Over 160 professionals in 16 offices – across all continents – are delivering the insight that can make a difference to your business.

For more information, please visit our website at https://www.pac-online.com.

For more information on the article , please contact:

Author:

Tobias Ortwein, Tel: +49 (0) 89 23 23 68-26,

t.ortwein@pac-online.com

PR Contact:

Katrin Wedding, Tel: +49 (0) 89 23 23 68-11

k.wedding@pac-online.com