Enterprises are now renewing their intentions to move into outsourcing environments in this post-recessionary environment. Unlike pre-recessionary days, however, the very nature of these outsourcing engagements will be more global in nature, and will not involve significant upfront capital expenditure

In past recessions, enterprises have increased both IT and business process outsourcing (BPO) initiatives to drive out cost, however, that has not been the case during the last nine months of severe economic downturn for most organizations. Like any significant business or IT investment or transformation exercise, most enterprises have put outsourcing plans on the back-burner while they tackle fundamental issues such as contemplating their very survival, effecting large redundancies, or engaging in M&A activity.

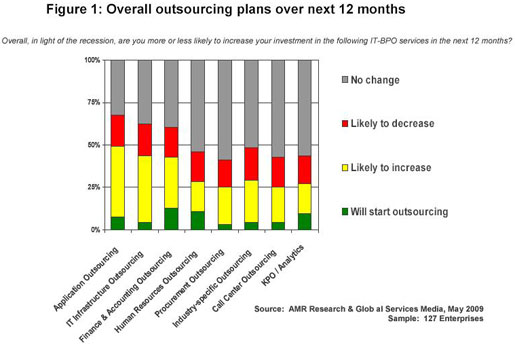

However, our new survey of outsourcing adoptions plans (Figure 1) indicates this tide is about to change as enterprises renew their intentions to move into outsourcing environments, especially in the mainstream applications and mature BPO domains.

The high-growth areas of application development/maintenance, IT infrastructure and transactional BPO, where there are mature service provider offerings available at low-cost and often low upfront investment requirements, are poised to resume a more aggressive adoption trajectory over the next year. We are anticipating some modest contract growth in Q3 this year and a notable adoptions spike of new contracts, and existing contract augmentation in Q4 and Q1 2010. Key trends of note:

So what’s driving this renewed growth, and what are the nuances which are changing the adoption landscape? Let’s investigate further.

Drivers and Inhibitors behind outsourcing reflect the new economy

Unlike pre-recessionary days, however, the very nature of these outsourcing engagements will be more global in nature, and will not involve significant upfront capital expenditure. For example, McKinsey recently revealed that 70% of its consulting engagements today are focused on cost-reduction as opposed to only 30% on new revenue generation.

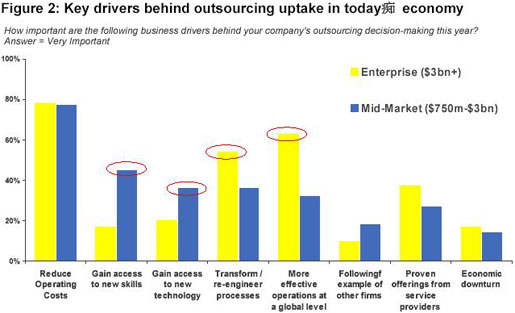

While the onus on firms today is to drive out as much cost as they can from their businesses (close to four-fifths view cost-reduction as the primary driver for outsourcing), other factors are becoming crucial for companies’ planning as they evaluating outsourcing business models, notably globalizing their businesses more effectively, re-engineering business processes, and accessing expertise from service partners.

Large enterprises view outsourcing as a vehicle for globalization, while mid-sized firms needs access to process acumen and technical skills

If there’s one thing this recession taught us, it is how integrated global economies and markets are today, how businesses need to adapt to move in and out of diverse regional markets, and how they must make rapid decisions to invest or divest global service / product lines in order to prosper.

While some firms are find it hard to make radical decisions in this downturn, others are clearly addressing how critical it is to operate as a global business, and this is especially the case with large enterprises ($3bn+ annual revenues), with 60% of enterprises viewing this as a very important factor in their outsourcing decision making (see Figure 2):

In addition to globalizing their businesses, over half of the large enterprises (54%) are considering outsourcing as a vehicle for re-engineering their business processes. Many firms have used the recession as an opportunity to focus heavily on eliminating wastage and streamlining poor process flows, for example using Six Sigma methodology, which has effectively put them in a much healthier position to move into outsourcing environments that can be underpinned by robust ERP and standardized processes. Outsourcing can provide a valuable change-agent for enterprises to drive these fundamental transformative measures through to fruition.

Many firms in pre-recessionary times have not been so diligent, opting for “lift and shift” outsourcing engagements whereby they transfer job functions from onshore staff to lower-cost offshore labor, with limited upfront process re-engineering. Inefficiencies are magnified several times over in an outsourced model, and customers must focus on a 72 month program of transforming process, investing in new technology platforms, and not a short-term 24 month “cost take-out” exercise, where they leverage a service provider to take on their back-office baggage and grant them cost-savings.

While large enterprises are clearly focused on improving their processes during outsourcing, only a third of mid-sized companies ($750m – $3bn annual revenues) view process transformation as a very important factor, while 45% cite their need to access new skills as very important. For example, many of AMR Research’s mid-sized clients are seeking to move into broader managed service agreements to gain better (and more cost-effective) access to application development skills, where they can develop long-term relationships with service provider talent than can work onsite with existing staff, in addition to providing low-cost support from offshore locations.

Disruption and Capital Investment are the clear impediments behind new outsourcing adoption

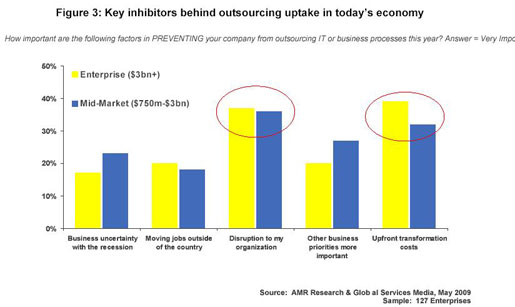

While the drivers behind both mid-sized and large organizations have some clear differences, the factors delaying decisions are remarkably similar (Figure 3):

While companies are tackling severe economic conditions, priorities clearly get focused on critical management decisions surrounding business focus, ensuring company stability through the volatility and uncertainty. The upheaval of moving complex process over to third-party providers and offshore locations is a challenge we have documented many times at AMR.

In many cases, the recession has brought caution to many firms when it comes to outsourcing, and has generated a lot of positive behavior in our clients. Shaving a few percentage points off the bottom-line is no longer the game-changer when companies are facing crucial decisions over their very survival. Service providers all have bulging sales pipelines these days – their problem is persuading their prospects to sign contracts. Outsourcing major pieces of companies’ support operations needs to be treated in light of the next 10-15 years for a company, not solely the next quarter on the balance sheet. Hence, there can be positive sides to uncertainly and fear.

Surprisingly, barely a fifth of enterprises state that jobs moving outside of the country in an important inhibitor behind outsourcing, which doesn’t reflect much of the media spotlight. It appears that while many people can voice projectionist views, but when it comes to driving cost from their corporate bottom-line it’s a different story.

What next for the Outsourcing Industry?

As the fog slowly lifts from the recession, companies are focusing more than ever on cost-containment and outsourcing clearly is a vehicle for driving out expense from the bottom line.

However, it needs to be combined with ongoing business transformation initiatives, and too many companies in the past have tried to exploit outsourcing to take out too much cost too quickly and been made to pay the penalty. Our data clearly indicates outsourcing will be (and already is) coming back with double-digit growth over the next few months, however, we do not expect to see as many mega-deals as yesteryear. They will be largely cautious, smaller-scope engagements, focused on lower up-front capital expenditure, supported by low-cost offshore and nearshore resources. The advent of SaaS/BPO promises to help deliver these principles, but we’re only at the beginning of the new wave of Opex-based outsourcing delivery.