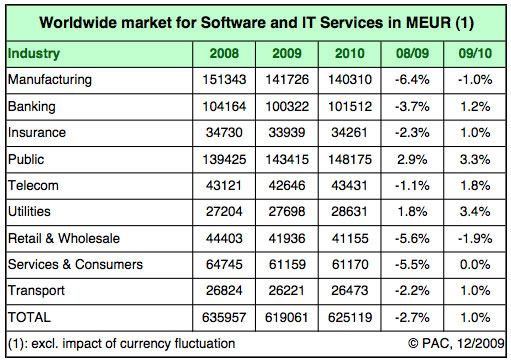

Following PAC’s recent commentary on the global IT investment expectations for 2010, and the related impact on the software and IT services industry, our consultants have also put together a brief analysis of the key distinctions expected by vertical sector this year.

London – February 8, 2010: “The economic crisis impacted the manufacturing sector most severely across the globe, particularly in the automotive, mechanical engineering, chemicals and metal sectors, while pharmaceuticals, food and aerospace & defense proved more resilient,” says Christophe Chalons, Chief Analyst of the PAC Group, based at PAC Munich. For manufacturing companies, the focus in 2010 will clearly remain on short-term savings through consolidation and standardization of both assets and contracts and particularly on outsourcing contracts.

“The recovery will not happen until the second half of this year and will be driven by investment in embedded systems, PLM – including integration with PDM, ERP and CRM – collaboration, MRO and CRM supporting after-sales services,” says Klaus Holzhauser, Director at PAC Munich. “We also expect progressive manufacturing projects in the integration of all these IT silos,” adds Stefanie Naujoks, Consultant at PAC Munich.

“The situation in banking will remain highly differentiated from country-to-country, depending on the level of government aid and the structure of the industry, such as the importance of investment banking, private banking and semi-public saving banks,” says Rajeena Brar, Consultant at PAC London. However, banks have benefited from the early recovery of the stock markets. “Banks will have several major issues to solve in 2010, with compliance continuing to generate the bulk of IT investments. Other issues include customer loyalty, post-merger integration, STP/ industrialization, data consolidation and processing, and these issues can only be solved through IT,” adds Vincent Gelineau, Senior Consultant at PAC Paris.

Insurance companies are in a slightly better situation, as revenues (premiums) are quite stable. “2010 investments topics include multi-channel integration, CRM, web-based, front-end and legacy modernization,” comments Eike Bieber, Consultant at PAC Munich.

“The public sector has been very resilient in most countries in 2009 as federal investment programs have supported demand; however municipalities and regional governments face decreasing tax income and most countries’ debt level will be a heavy burden for the years to come,” says Arnold Aumasson, Senior Consultant at PAC Paris. “PAC expects a progressive slowdown of growth in spending despite the implementation of new bookkeeping standards, regulations such as the European service rule and some hotly anticipated e-government projects,” adds Martin Barnreiter, Senior Consultant at PAC Munich. “The biggest difference between the countries is that outsourcing is highly developed in countries like the UK or Australia, while countries like France, Eastern Europe and China are late adopters,” says Peter Russo, Director at PAC New York.

Telecom should continue to suffer from strong price pressure. “Major IT in 2010 projects will include NGN (next generation networks) and the development of new (value added) services (mobile payments, web 2.0, content, etc.),” says Julia Reichhart, Director at PAC Munich.

“Utilities are both a traditionally resilient market and are benefiting from some industry-specific issues: liberalization, unbundling, information management, smart grid and smart metering,” comments Karsten Leclerque, Director at PAC Munich. Similar to the public sector, outsourcing tendencies vary strongly between countries.

Retail will remain a very difficult market in most countries, especially in countries dominated by discounters. “Discounters are well known to be both very economical and the toughest purchasers,” says Philipp Schalla, Consultant at PAC Munich. “On one hand, there should be interesting investment areas such as materials management, BI and multi-channel integration. On the other hand, the retail market might be hit hard by bankruptcies,” adds Peter Russo.

Services and consumers is a very un-homogeneous industry and very much impacted by the crisis. “Interesting investment areas will include multi-channeling and billing in media and process automation in professional services,” adds Christophe Chalons.

Transport includes both logistics (strongly impacted) and passenger transportation (less affected, except airlines). “Investment areas in 2010 should include fourth-and-fifth-party logistics and customer-oriented solutions such as ticketing, check-in, portals, and payments,” says Frederic Giron, Director at PAC Paris.

Overall, the recovery is expected in the course of 2010, sooner or later depending on the country and on the vertical sector. PAC remains cautious as there are still important risks linked with unemployment, credit crunch and resulting bankruptcies. “Even if volumes are expected to recover in the course of 2010, average prices and rates will be lower than in 2009, thus limiting market recovery,” concludes Christophe Chalons.

About Pierre Audoin Consultants (PAC): Pierre Audoin Consultants (PAC) is a global market research and strategic consulting firm for the Software and IT Services Industry (SITSI). PAC helps IT vendors, CIOs, consultancies and investment firms by delivering analysis and advice to address a range of growth, technology, financial and operational issues.

Our 30+-year heritage in Europe – combined with our US presence and worldwide resources – forms the foundation of our ability to deliver in-depth knowledge of local IT markets, anywhere. We employ structured methodologies – undertaking thousands of annual face-to-face interviews on both the buy and sell side of the market, as well as a bottom-up, top-down approach – to leverage our research effectively.

PAC publishes a wide range of off-the-shelf and customized market reports – including our best-selling SITSI® program – in addition to our suite of strategic consulting and market planning services. With 16 offices across all continents, we deliver the insight that can make a difference to your business.

For information on the article, please contact:

Christophe Chalons

Chief Analyst

Tel: +49 (0) 89 23 23 68-17,

c.chalons@pac-online.com

Press Contact:

Shelly Wills

Group Marketing Coordinator

Tel: +44 (0) 20 7553 3965

s.wills@pac-online.com

Pierre Audoin Consultants (PAC) Ltd

15 Bowling Green Lane,

London EC1R 0BD, UK

Tel: +44 (0) 20 7251 2810

Fax: +44 (0) 20 7490 7335

Web: www.pac-online.com